Introducing JioFinance APK: More Than Just a Financial App

Let’s paint a picture of JioFinance APK, an innovative force in the bustling bazaar of digital banking and UPI payments. Developed by the tech-savvy minds at Jio Financial Services, this app isn’t just another player in the financial app market; it’s a pioneer. From its inception, JioFinance was crafted with a vision to blend daily finance management with robust digital banking functionalities, offering a seamless platform that caters to the tech-forward population.

JioFinance app is designed for a diverse audience, from tech enthusiasts who crave simplicity to young professionals eager to manage their finances without the hassle of traditional banking. The app’s user interface is a fresh breath of digital air, welcoming users with intuitive navigation and a clutter-free design from the very first tap.

Core Features of JioFinance App That Set It Apart

Diving into the core features, JioFinance APK emerges as a holistic UPI hub. It simplifies transactions across the board, ensuring that everything from paying your utility bills to transferring money is as easy as a few clicks. What makes it standout? Its unique rewards system that turns everyday transactions into opportunities for users to earn benefits, enhancing the gameloop of financial activities. The app also seamlessly integrates with Jio Payments Bank, pushing the boundaries of what digital banks can offer. Security is paramount, with multiple layers of protection safeguarding user data and transactions, ensuring peace of mind for its users.

The Seamless Digital Banking Experience with JioFinance Mobile

Imagine a banking experience that is boundless, one that offers zero balance accounts with a lucrative 3.5% interest rate. JioFinance APK redefines online banking with these features, making it not just accessible but also financially rewarding. The process of opening a digital savings account is streamlined, taking you from login to transaction-ready in just minutes. Customer support is another cornerstone of the JioFinance experience, available 24/7 to ensure that every query and concern is addressed. This commitment to user satisfaction sets JioFinance apart from traditional banking, where rigid hours and lengthy processes can be deterrents.

JioFinance Free’s Unique Approach to Everyday Financial Transactions

JioFinance APK isn’t just about managing money; it’s about enhancing how we interact with our finances on a daily basis. The app excels in facilitating effortless and secure money transfers, accommodating everything from small personal payments to substantial business transactions.

What’s truly captivating are the real-life success stories from users who have found financial solace and empowerment through JioFinance. These anecdotes not only illustrate the app’s reliability but also its role in transforming financial tasks into simple, quick actions. Moreover, the promise of new features and enhancements keeps the community eager and engaged, continuously evolving the user experience.

Revolutionary Tools for Spending Analysis and Financial Management

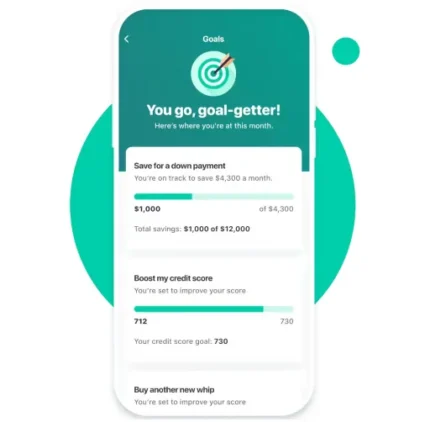

In the bustling world of finance management apps, the JioFinance APK stands out with its ‘My Money’ feature, a veritable command center for your financial life. This feature not only provides an integrated view of all your financial accounts but also makes it a breeze to navigate your economic landscape. The benefits of such consolidation are manifold; by having a unified view, you can see your financial health at a glance—no more tab switching or app hopping.

The tools for budgeting and saving within JioFinance are not just functional; they’re a game-changer. Effective would be an understatement—they are transformative, making it simple to set financial goals and even simpler to track progress toward them. User testimonials often highlight this as a major factor in their financial empowerment, showing significant savings growth thanks to these intuitive tools. Comparatively speaking, JioFinance app holds its ground robustly against other financial management apps. It’s not just about managing your money; it’s about enhancing your financial wisdom and making your money work for you.

Exploring the Insurance and Investment Features of JioFinance Latest Version

Navigating through the maze of insurance products can be daunting, but JioFinance APK simplifies this with an array of options that are as comprehensive as they are easy to compare. From selecting the perfect insurance plan to fitting it into your financial landscape, JioFinance turns a complex decision into a series of simple taps on your screen.

For those new to investing, JioFinance serves as a gentle introduction to the world of financial growth opportunities. Here, beginners can find not just resources, but real, actionable investment avenues that are explained in a way that demystifies the often intimidating world of stocks, bonds, and mutual funds. Feedback from users who have delved into the insurance and investment features often cite the strategic advantage of managing these from the same platform where they handle their daily banking. This synergy is something they value highly, for convenience as well as for the coherence it brings to their financial strategy.

Rewards and Incentives in JioFinance on Android

The rewards system within JioFinance APK is designed to not just lure users but to create a lasting relationship with them. Here, every transaction is an opportunity to earn, and this feature richly benefits the users, turning everyday financial activities into rewarding experiences. Real-life stories from the community show users maximizing these benefits extensively, which not only enhances their engagement with the app but also fosters a sense of loyalty and community. Compared to competitors, JioFinance’s reward system is not just competitive but often leads the pack, offering more value and more reasons to stay engaged.

What’s Next for JioFinance APK?

Peering into the crystal ball, the future of JioFinance APK looks not just promising but pioneering. Insights from the developers reveal an exciting array of features slated for upcoming updates, each designed to enhance user experience and streamline financial management further. The role of user feedback in shaping these future versions cannot be overstated—it is integral and highly valued. This feedback loop ensures that JioFinance remains on the cutting edge, not just technologically but in satisfying user needs and preferences. As the landscape of digital banking evolves, JioFinance is poised not just to adapt but to lead. Predictions for the future of digital banking see JioFinance not just participating in the evolution but driving it, setting new standards for what a finance app can be.

Reviews

There are no reviews yet.